Smart Financial planning is not about chasing quick returns or timing the market. It’s about creating a solid foundation that protects you from life’s uncertainties while guiding you toward your goals. Think of it like building a house: before you worry about paint colors or furniture, you need to make sure the foundation is strong enough to support everything above it.

Over the years, I’ve realized that most people either jump directly into investments without protecting their risks, or they save endlessly without letting their money grow. Both approaches leave huge gaps in the financial journey.

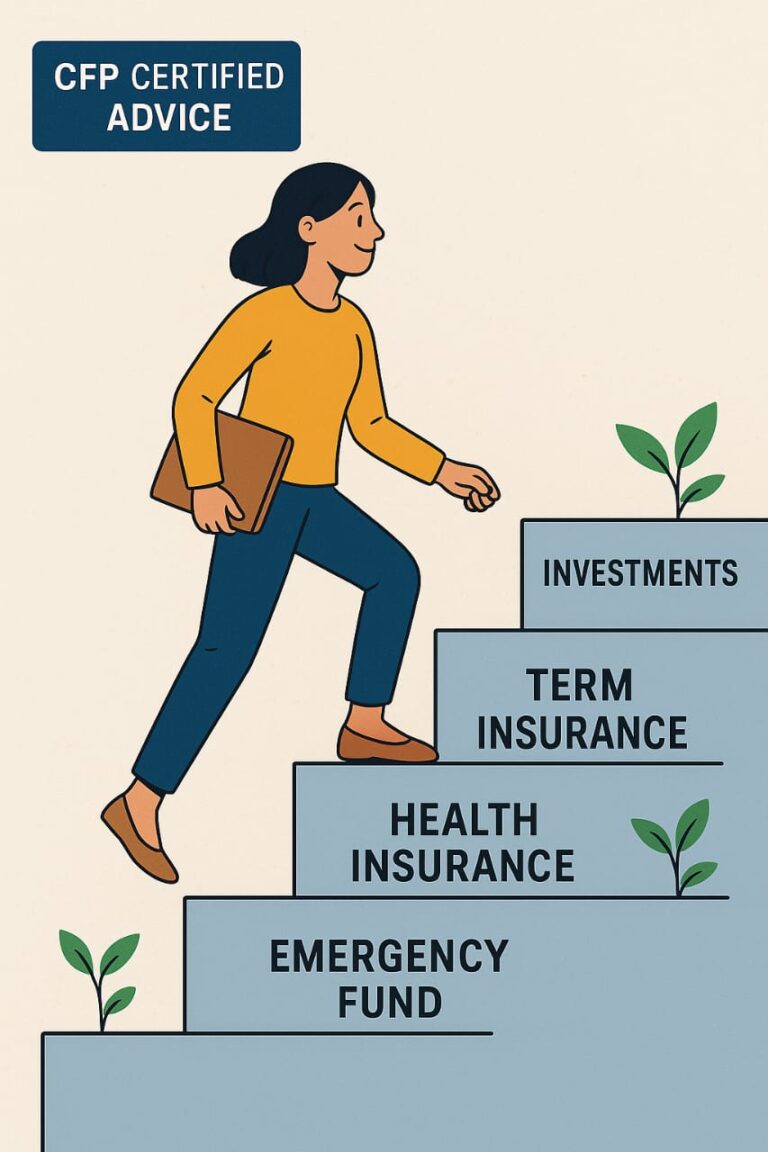

As a CFP-Certified Planner, I believe every financial plan must rest on four essential pillars:

- Emergency Fund

- Health Insurance

- Term Insurance

- Investments (Short, Medium, and Long-term Goals)

Let’s go step by step and understand how these four pillars work together to secure your financial life.

Table of Contents

1. Emergency Fund – Your First Line of Defense

What is an Emergency Fund?

An emergency fund is simply money kept aside to deal with unexpected expenses—like medical emergencies, job loss, urgent travel, or major home repairs. It’s not for vacations, gadgets, or impulse buys.

Think of it as your personal safety net. If life throws a curveball, you don’t need to break your investments, swipe credit cards, or borrow from friends.

How Much Should You Keep?

A common rule of thumb is:

3 to 6 months of expenses if you’re single with stable income.

6 to 12 months of expenses if you have dependents or irregular income (like business owners or freelancers).

Example:

If your monthly household expense is ₹50,000, your emergency fund should ideally be ₹3,00,000 – ₹6,00,000.

Where Should You Park It?

Savings Account (High Liquidity): Good for instant access, though returns are low.

Liquid Mutual Funds: Safe, slightly better returns, and money can be withdrawn in 1 day.

Fixed Deposits (FDs): If you want safety with moderate liquidity.

Avoid investing your emergency fund in stocks or long-term products. Liquidity and safety matter more than returns here.

Why is it Important?

Without an emergency fund, even a small financial shock can derail your long-term goals. Imagine selling your retirement investments just because your car broke down or your child had a sudden medical need. That’s financial mismanagement.

Without an emergency fund, even a small financial shock can derail your long-term goals. Imagine selling your retirement investments just because your car broke down or your child had a sudden medical need. That’s financial mismanagement.

2. Health Insurance – Protecting Your Wealth from Medical Shocks

Why Health Insurance is Non-Negotiable

Medical inflation in India is rising at 10-12% annually. A single hospital stay can wipe out years of savings. Even if your employer provides health insurance, it may not be enough—or you may lose it when you switch jobs.

Types of Health Insurance

Individual Health Insurance: Covers one person with a defined sum insured.

Family Floater Policy: Covers the whole family under one plan. More cost-effective if you’re young with healthy dependents.

Top-Up / Super Top-Up Plans: Boosts your existing coverage at a lower cost.

How Much Coverage is Enough?

Minimum: ₹5–10 lakh per individual in metro cities.

Ideal: ₹15–25 lakh family floater + top-up of ₹25–50 lakh.

Example: A family of four in Bengaluru should aim for at least ₹15 lakh base cover plus a top-up of ₹35 lakh.

Key Features to Look For

Cashless hospital network.

No claim bonus.

Pre and post-hospitalization cover.

Minimal exclusions.

Why Not Rely Only on Employer Health Insurance?

Because:

Coverage may end when you switch jobs.

Sum insured may be too low.

Retired employees are usually not covered.

Having your own independent policy ensures continuity and peace of mind.

3. Term Insurance – Protecting Your Family’s Future

What is Term Insurance?

Term insurance is the purest form of life insurance. You pay a small premium, and in return, your family gets a large payout (sum assured) if something happens to you during the policy term.

It’s not an investment—it’s protection.

Why Do You Need It?

If you are the breadwinner, your family depends on your income. Without you, their financial future could collapse. Term insurance ensures your goals (children’s education, family’s living expenses, loans) are not compromised.

How Much Cover Should You Take?

A simple formula:

15–20 times your annual income.

Example: If your annual income is ₹12 lakh, you should have ₹2–2.5 crore cover.

Features to Check

Policy term till at least age 60–65.

Critical illness riders.

Accidental death benefit riders.

Waiver of premium (if disabled).

Myths About Term Insurance

“Premiums are wasted if nothing happens.”

Not true. You don’t complain if you don’t meet with an accident despite wearing a helmet, right? The peace of mind itself is worth it.“I already have insurance through my employer.”

Employer-provided insurance is usually inadequate (₹10–20 lakh). It won’t be enough for your family’s long-term needs.

Pro Tip

Buy term insurance early. Premiums rise with age and health issues.

4. Investments – Growing Wealth for Short, Medium & Long-Term Goals

Once your risks are covered (via emergency fund, health, and life insurance), the next step is to make your money work for you. Savings protect you today, investments build your tomorrow.

Categorizing Goals

Short-Term Goals (1–3 years)

Examples: Vacation, buying a gadget, emergency medical buffer.

Best Options:

Recurring Deposits (RDs).

Liquid or Ultra Short-Term Funds.

Short-term FDs.

Avoid equities for short-term goals because market fluctuations can harm you.

Medium-Term Goals (3–7 years)

Examples: Car purchase, down payment for house, children’s school fees.

Best Options:

Balanced Advantage Funds.

Debt Funds + Small Allocation to Equity.

Fixed Deposits (for conservative investors).

Long-Term Goals (7+ years)

Examples: Retirement, children’s higher education, wealth creation.

Best Options:

Equity Mutual Funds (SIP): Best way to beat inflation and create wealth.

PPF/EPF/NPS: Good for retirement with tax benefits.

Stocks/ETFs: If you have knowledge and appetite for risk.

Asset Allocation – The Golden Rule

Diversify across asset classes:

Equity: Growth engine for long-term wealth.

Debt: Stability and regular income.

Gold/REITs: Hedge against inflation and volatility.

Example of a Balanced Plan

For a 30-year-old earning ₹1 lakh per month:

Emergency Fund: ₹4 lakh.

Health Insurance: ₹15 lakh floater + ₹35 lakh top-up.

Term Insurance: ₹2 crore.

Investments: ₹25,000 SIP in equity funds, ₹10,000 in debt funds, ₹5,000 in gold ETF.

This ensures protection + growth + future security.

Bringing It All Together – The Financial Planning Pyramid

You can visualize smart financial planning as a pyramid:

Base Layer: Emergency Fund.

Second Layer: Health and Term Insurance.

Top Layer: Investments for goals.

If you skip the base layers and directly jump to investments, the pyramid will collapse when life throws challenges.

Final Thoughts

Financial planning isn’t about picking the hottest mutual fund or chasing the latest stock tips. It’s about discipline, protection, and goal-based investing.

An Emergency Fund ensures short-term peace of mind.

Health Insurance shields you from rising medical costs.

Term Insurance secures your family’s future.

Investments help you achieve dreams and build long-term wealth.

These four pillars are not optional—they are essential. If you build them early, you will not only survive financial shocks but also thrive in your wealth-building journey.

Remember, money is not just about numbers. It’s about security, freedom, and the ability to live life on your own terms.

👉 “Also read: Journey from Banking to Wealth Management”