Introduction: Why Habits Matter More Than High Income

As a Certified Financial Planner (CFP®) and wealth advisor, I often meet people who earn exceptionally well but still struggle financially. Why? Because wealth is less about how much you make and more about the habits you build around money.

In 2025, India is witnessing rapid changes—new tax rules, digital payments, AI-driven banking, and increasing global market integration. Amid this, your financial habits are your best defense against uncertainty and your strongest tool for wealth creation.

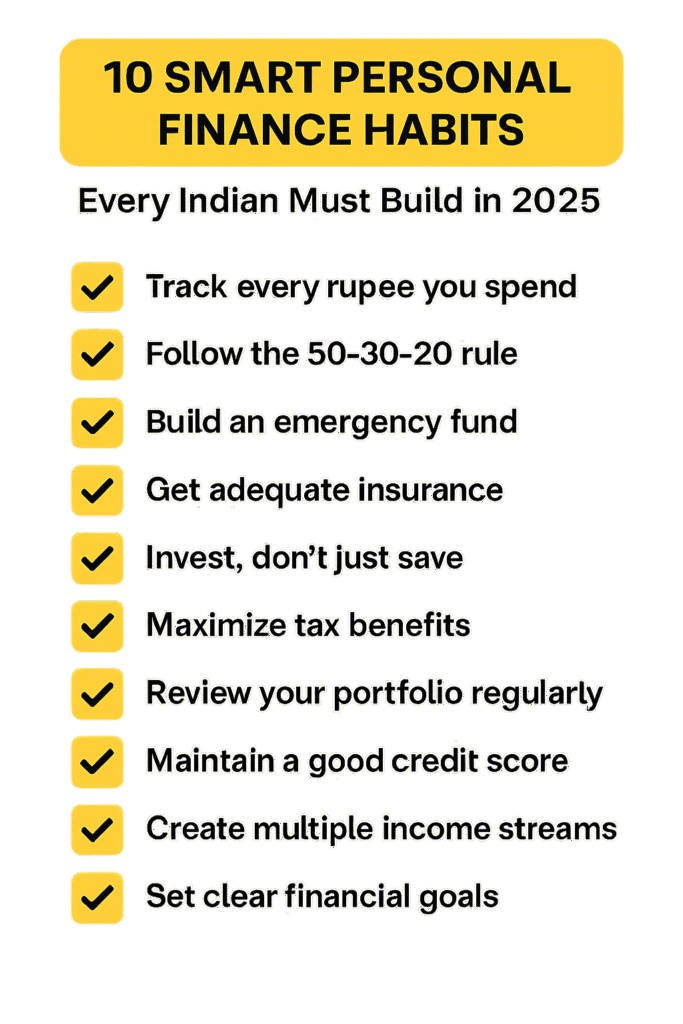

Let’s explore the 10 personal finance habits every Indian should cultivate this year.

1. Track Every Rupee You Spend

I remember one client who felt “broke” every month despite a ₹25 lakh annual package. Once we tracked his spends, we found ₹18,000/month vanishing into food delivery apps.

- Habit: Use apps like Walnut, Money View, or even a simple Excel sheet to track expenses.

- Why it matters: Awareness = control. You can’t fix what you don’t measure.

2. Follow the 50-30-20 Rule

The old Indian mindset of “save whatever is left” no longer works. Instead:

50% → Needs (rent, groceries, bills)

30% → Wants (travel, dining, shopping)

20% → Savings/Investments

Habit: Automate your 20% savings by setting up SIPs right after your salary credits.

Why it matters: You pay yourself first, not last.

3. Build and Maintain an Emergency Fund

If 2020–2021 taught us anything, it’s that emergencies strike without warning. Job loss, medical bills, or business slowdowns can derail years of progress.

Habit: Keep at least 6 months’ expenses in a liquid fund or savings account.

Why it matters: You won’t need to break FDs or redeem mutual funds at the wrong time.

4. Get Adequate Insurance – Don’t Just Depend on Employer Cover

A friend once told me proudly, “I don’t need health insurance, my company covers me.” Then a job change left him uninsured for 3 months—and one hospitalisation cost ₹2.8 lakh.

Habit:

Term Insurance: 10–15× annual income.

Health Insurance: At least ₹10–20 lakh family floater, beyond employer cover.

Why it matters: Insurance is not an investment—it’s protection.

5. Invest, Don’t Just Save

In 2025, inflation still eats into your money. A ₹1 lakh FD at 6% grows to ₹1.06 lakh, but real inflation (say 5.5%) reduces effective gains to almost nil.

Habit:

Equity Mutual Funds for long-term wealth.

Debt Funds/FDs for stability.

Gold/SGB for diversification.

Why it matters: Savings protect, investments grow. Both are essential.

6. Maximise Tax Benefits (Smartly)

With the new 2025 Income Tax rules (zero tax up to ₹12 lakh), many won’t need aggressive tax-saving. But that doesn’t mean ignoring smart options:

NPS (extra ₹50,000 deduction)

Health Insurance (80D)

Habit: Don’t invest in a product only to save tax—ensure it fits your goals.

Why it matters: Tax planning should align with wealth building.

7. Review Your Portfolio Regularly

A client once told me he invested in a mid-cap fund in 2018 and hadn’t touched it since. When we reviewed in 2024, the allocation had ballooned to 60% mid-cap—high risk.

Habit: Review once every 6 months:

Asset allocation (Equity vs Debt vs Others).

SIP performance.

Goal alignment.

Why it matters: Markets change, and so should your strategy.

8. Maintain a Good Credit Score

Credit score is like your financial Aadhaar—it impacts loan approvals, interest rates, and even job applications (yes, some employers check it).

Habit:

Pay EMIs/credit card bills on time.

Keep credit utilisation <30%.

Don’t take unnecessary loans.

Why it matters: A score of 750+ means cheaper loans when you actually need them.

9. Create Multiple Income Streams

Relying only on salary is risky. In 2025, side hustles, freelancing, and digital assets are mainstream.

Habit: Explore:

Freelancing (content, design, consulting).

Dividend-yielding stocks.

Rental income.

Why it matters: Multiple incomes = financial security.

10. Set Clear Financial Goals

Without goals, money drifts. I once asked a client, “Why do you want to invest ₹50,000/month?” He said, “Because everyone does SIP.” That’s not a goal.

Habit: Define:

Short-term (vacation, car).

Medium-term (house downpayment).

Long-term (retirement, child’s education).

Why it matters: Goals give purpose to every rupee.

My Personal Take as a CFP

I’ve worked with clients who earn ₹6 lakh and those who earn ₹60 lakh. The difference in their financial success wasn’t income—it was habits. The disciplined ₹6 lakh earner often outpaces the careless ₹60 lakh earner in long-term wealth.

Money is not just maths—it’s behavior. And behavior is built on habits.

FAQs

Q1. How much should I save every month in 2025?

Aim for at least 20% of your take-home salary. Automate it via SIPs.

Q2. Is ₹1 crore enough for retirement in India?

Depends on lifestyle. For most, ₹3–5 crore corpus is more realistic, considering inflation. Start early with SIPs.

Q3. Should I use the new tax regime or old regime?

For most salaried under ₹12 lakh, the new regime (zero tax till ₹12 lakh) is better. Compare both using online calculators.

Q4. Is cryptocurrency a good investment in 2025?

Treat it as speculative. If at all, restrict to <5% of your portfolio, and only via regulated channels.

Q5. What’s the safest first step if I’ve never invested before?

Start with index mutual funds via SIP. Low cost, diversified, and beginner-friendly.

Conclusion: Start Small, Stay Consistent

In 2025, personal finance is not about big leaps—it’s about small, smart habits practiced daily. Whether you’re earning ₹30,000/month or ₹3 lakh/month, the 10 habits above can transform your financial future.

As a CFP, my advice is simple: don’t wait for the “perfect time” or “extra income.” Start now, start small, and watch consistency compound into wealth.