Introduction – Why Retirement Planning Matters More Than Ever

When I first started my career in banking, retirement seemed like a distant concept. Back then, all I focused on was building my career, buying things I wanted, and saving a little here and there. But over time, especially as I transitioned into wealth management, I realized something powerful: retirement planning is not about old age — it’s about freedom.

Freedom to spend time with your family without worrying about bills.

Freedom to travel, pursue passions, or even start something new without financial stress.

Freedom to live on your own terms.

And in my personal journey, one tool stands out as the most effective for building retirement wealth in India: Mutual Funds.

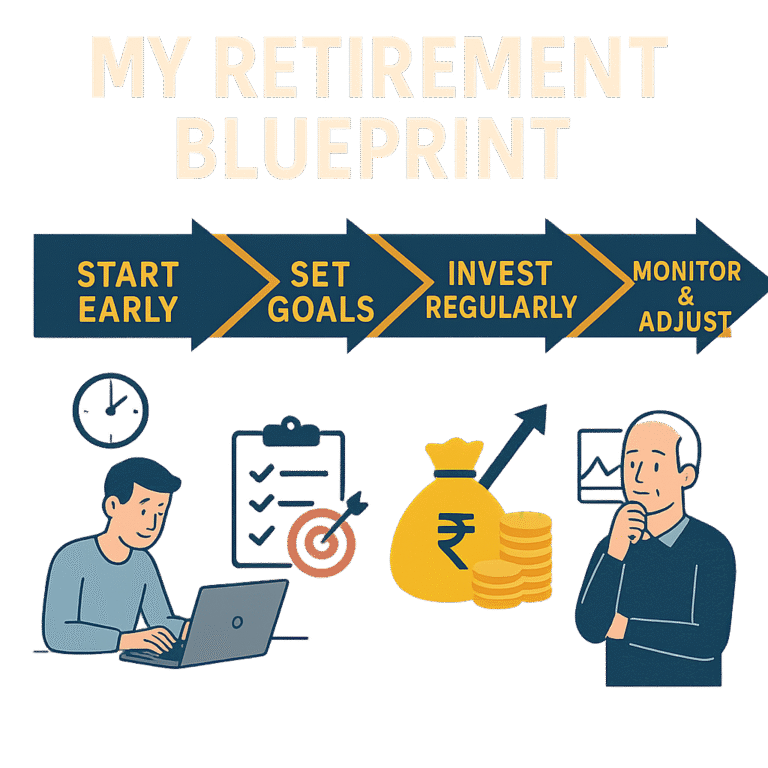

This blog is part of my “Retirement Blueprint” series, where I share personal lessons and practical strategies. Today, I’ll explain why mutual funds can be your best friend in building wealth for retirement.

Table of Contents

Chapter 1: The Big Shift – From Saving to Investing

When I worked in banking, I saw how most people approached retirement:

Keep money in FDs.

Buy a life insurance policy.

Maybe open a PPF account.

These are all safe, but they are not enough. Why? Because they barely beat inflation.

Example: If inflation averages 6% and your FD gives 5.5% (taxable), your money is actually losing value every year.

That’s when I realized — if you want to build wealth for 20–30 years into retirement, you need to shift from saving to investing. And that’s where mutual funds step in.

Chapter 2: Why Mutual Funds Work for Retirement

Here’s why I personally recommend mutual funds for retirement planning:

Power of Compounding

A ₹10,000 monthly SIP growing at 12% for 30 years = over ₹3.5 crore.

Retirement is a long-term goal, and compounding rewards patience.

Diversification

Mutual funds spread your money across many companies and sectors.

This reduces the risk compared to investing in a few individual stocks.

Flexibility

You can choose equity funds (for growth), debt funds (for safety), or hybrid funds (balance of both).

As you near retirement, you can gradually shift from high-risk equity to safer debt.

Professional Management

Fund managers and research teams manage your money — so you don’t need to pick stocks yourself.

Tax Efficiency

Equity funds: LTCG tax at 10% over ₹1 lakh.

Debt funds: Indexation benefits (when applicable).

Much more efficient than taxable FD interest.

Chapter 3: SIPs – The Retirement Superpower

When clients ask me, “What’s the simplest way to build retirement wealth?” my answer is always: SIP (Systematic Investment Plan).

Small amounts invested regularly.

Rupee-cost averaging (you buy more units when markets are low).

Compounding works best with consistency.

Example:

₹5,000/month for 30 years @ 12% → ~₹1.75 crore.

₹10,000/month for 30 years @ 12% → ~₹3.5 crore.

The earlier you start, the less you need to invest later. That’s why SIPs are the cornerstone of my retirement blueprint.

Chapter 4: Types of Mutual Funds for Retirement

Not all mutual funds are the same. For retirement planning, here’s how I structure portfolios for myself and my clients:

Equity Mutual Funds (Growth Engine)

Large-cap funds → Stability + long-term growth.

Flexi-cap/multi-cap funds → Balanced exposure across market caps.

ELSS funds → Tax saving + equity growth.

Debt Mutual Funds (Stability)

Short-term debt funds for safety.

Good for near-retirement phase to protect capital.

Hybrid Funds (Balance)

Combine equity + debt in one fund.

Ideal for those who don’t want to manage asset allocation themselves.

Retirement-Specific Mutual Funds

Some AMCs offer retirement-focused funds with long-term lock-in.

Useful if you want discipline + structure.

Chapter 5: Risk Management – Don’t Ignore This

Many people hesitate with mutual funds because of market volatility. Yes, equity funds go up and down. But here’s the key:

👉 Retirement is a 20–30 year journey.

Short-term volatility doesn’t matter if you stay invested. What matters is:

Start early.

Stay consistent.

Don’t panic during market falls.

One of my clients started a SIP in 2008 — right before the global financial crisis. His portfolio fell 40% in the first year. But he stayed invested. Today, that portfolio is worth over 8 times his investment.

That’s the power of long-term patience.

Chapter 6: My Personal Formula – The Retirement Glide Path

Here’s how I structure retirement portfolios:

Age 25–40 (Wealth Building): 70–80% equity funds, 20–30% debt/hybrid.

Age 40–50 (Balancing): 60% equity, 40% debt/hybrid.

Age 50–60 (Preservation): 40% equity, 60% debt/hybrid.

Post-Retirement: Focus on debt funds, hybrid, and SWP (Systematic Withdrawal Plan) for monthly income.

This gradual shift — called a glide path — ensures you build wealth when young and preserve it when older.

Chapter 7: Common Mistakes to Avoid

Starting late → You’ll have to invest much more.

Stopping SIPs during market falls → That’s when you buy cheapest.

Not diversifying → Don’t put everything in one fund.

Ignoring inflation → Retirement costs may be 4–5x higher in 30 years.

Treating retirement money as emergency fund → Keep them separate.

Chapter 8: Action Plan – How to Start Your Retirement Blueprint

Define your retirement age (60? 55?).

Estimate expenses (today’s ₹50,000/month may become ₹2–3 lakh/month in 30 years).

Use a Retirement Calculator (FinBees offers one).

Start SIP in 2–3 equity funds.

Review annually.

Rebalance every 5 years (shift part from equity to debt as you age).

Conclusion – My Retirement Blueprint

For me, retirement planning is not about money. It’s about freedom, dignity, and choice. Mutual funds are simply the best tool I’ve found to get there.

My blueprint is simple:

Start early.

Stay disciplined with SIPs.

Diversify smartly.

Shift gradually from growth to safety.

If you follow this path, you’ll not only save enough for retirement but also build the confidence that your future is secure.

👉 This is my blueprint. What will yours look like?